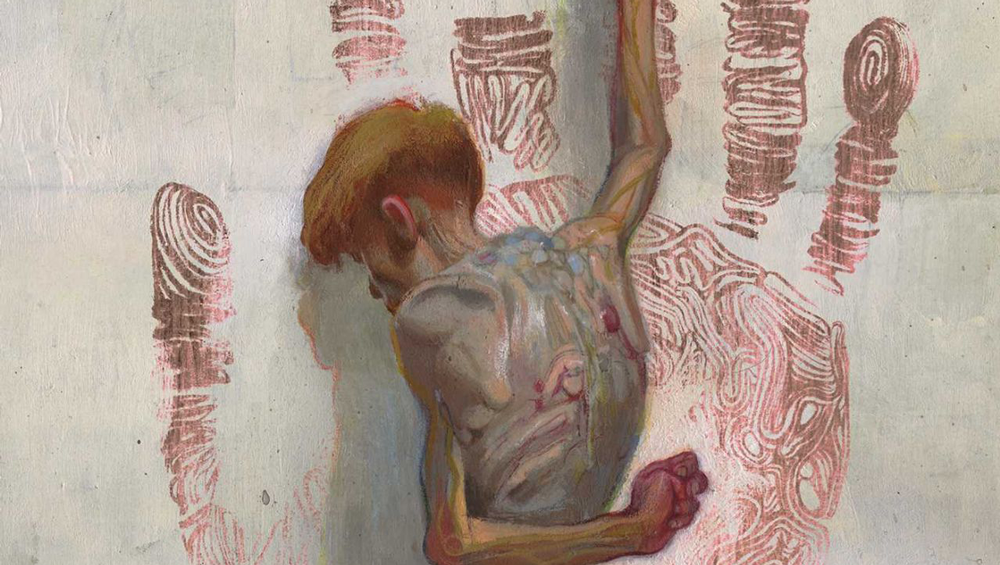

There is a story people like to tell about artists and money. It usually sounds practical, even reasonable. Artists are irresponsible. Artists are unrealistic. Artists do not think long term. The story survives because it allows judgment without understanding. It treats outcomes as evidence and ignores the conditions that produced them.

What is often mistaken for incompetence is exposure.

Artists operate without insulation. Income is tied to taste, judgment, and the willingness of others to choose you. It arrives unevenly, ends abruptly, and rarely comes with explanations. There is no floor beneath most creative work, no guarantee that yesterday’s stability will still exist tomorrow. Under those conditions, money does not behave like an abstract resource. It behaves like something closer to continuity.

This is why much financial advice aimed at artists never quite lands. It assumes decisions are made calmly, with predictability and margin for error. Artists usually encounter money when time is compressed and options are narrow. Rent does not wait. Work is not guaranteed. Comparison is unavoidable. In that environment, money stops being a neutral tool and starts absorbing meaning it was never designed to carry.

Early career survival reinforces this. Feast-or-famine income trains reflexes. Saying yes feels correct. Overextending feels responsible. Rest feels unsafe. These behaviors are not signs of immaturity or poor character. They are adaptations to volatility. The problem is not that they exist, but that once learned, they tend to persist even when circumstances change.

Over time, attachment to money distorts perception. When things go well, there is pressure to secure more before it disappears. When things go poorly, the loss feels personal, as though something essential has been revealed. Comparison sharpens both reactions. Money quietly becomes a proxy for stability, legitimacy, and control, even though it cannot reliably provide any of those things.

Calling this “being bad with money” is inaccurate. It replaces understanding with dismissal. It assumes behavior emerges in a vacuum, rather than in response to risk.

Artists are not deficient. They are navigating a profession with very little margin for error. When that reality is acknowledged plainly, without sentimentality or contempt, it becomes possible to relate to money more clearly, not as a judgment or a guarantee, but as a limited tool in an uncertain world.

Until fear is understood, advice is just noise.

Discussion